Trump vs. Harris: Tax Policy Showdown

The Wall Street Journal

96

0

In the 2024 election, Donald Trump and Kamala Harris are shaping their tax policies in starkly different ways that could significantly impact American households and corporations alike. Trump advocates for substantial tax cuts primarily benefiting corporations and higher-income earners, drawing from his previous administration's Tax Bill of 2017, which included significant benefits such as lowering the corporate tax rate from 21% to 15% and eliminating income taxes on Social Security benefits. This move, however, bears a potential cost of over $6.5 trillion over ten years. On the other hand, Kamala Harris aims to provide tax cuts focused on middle and lower-income families while increasing taxes on wealthy individuals and corporations. She has proposed an expansion of the Child Tax Credit and a substantial first-time homebuyer credit, costing approximately $4 trillion over ten years. Harris's tax plan aligns with President Biden's objectives, including increasing the corporate tax rate to 28% and introducing a minimum tax for ultra-wealthy individuals. Both candidates are also presenting plans that could have significant ramifications amidst a divided government where passing tax legislation could be problematic. By the end of the year 2025, if no deal comes through, Americans may face widespread tax increases, impacting nearly 60% of households.

Highlights

- • Trump proposes $2 trillion more in tax cuts than Harris.

- • Harris aims to cut taxes for households earning under $400,000.

- • Trump suggests lowering corporate tax from 21% to 15%.

- • Harris's plan includes expanded Child Tax Credit for families.

- • Trump's tariffs on imports could significantly raise prices for households.

- • Harris adopts Biden's tax plans, focusing on the rich.

- • Ending income tax on Social Security could cost $1.8 trillion.

- • Both candidates' plans may face challenges in a divided Congress.

- • 60% of Americans could see tax increases by 2026 without new legislation.

- • Tariff proposals could raise costs for the average household by $1,700 annually.

* dvch2000 helped DAVEN to generate this content on

09/12/2024

.

More news

Chaos Erupts in A Fazenda 16

Oct 27, 2024

Yoon's Emergency Declaration Raises Legal Concerns

Dec 04, 2024

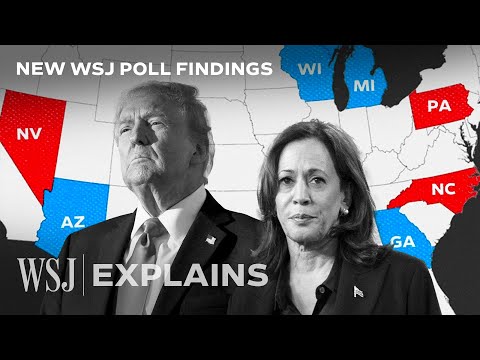

Poll Reveals Tight Race in Battleground States

Oct 15, 2024

Trump Visits Paris for Notre Dame Reopening Event

Dec 03, 2024

Empowering Black Women: A Celebration of Heritage

Aug 23, 2024

WhatsApp's New AI Tool Faces User Backlash

Oct 27, 2024