Wall Street Reaches Record Highs Amid Fed Easing Policy

Yahoo Finance

77

0

On Wall Street, the day unfolded with the Dow and S&P 500 closing at new all-time highs, reflecting investor optimism in the face of a new Fed monetary policy. Bob Elliot, co-founder, CEO, and CIO of Unlimited Funds, emphasized the Fed's commitment to significant monetary easing despite asset prices already at elevated levels. This environment, he believes, is conducive to growth, contrasting concerns expressed in the bond market about a looming downturn. The performance of sectors was mixed; while the S&P 500 hit fresh records, technology stocks showed signs of pressure while utilities thrived. Elliot pointed out that high expectations in the mega-cap tech segment may be challenging to sustain, suggesting a cooling-off period might be beneficial. He also discussed the implications of the Fed's recent interest rate cuts which were described as potentially protective even in a robust economy. Elliot warned of an impending inflationary pressure due to the accommodative stance which may not get fully reflected in the reported data for another year or two, alluding to a disconnect that might influence market conditions ahead.

Highlights

- • Wall Street marks record highs with Dow and S&P 500.

- • Fed adopts a more accommodative monetary easing policy.

- • Sector performance varies; tech stocks under pressure.

- • Utilities show strong performance amidst market fluctuations.

- • High expectations in tech companies may lead to cooling.

- • Fed's interest rate cuts aim to protect against downturns.

- • Elliot highlights future growth potential amidst easing.

- • Inflationary pressures expected despite Fed's easing tactics.

- • Long-term effects of cuts may not be immediately visible.

- • Market dynamics shifting with varied sector recoveries.

* dvch2000 helped DAVEN to generate this content on

09/24/2024

.

More news

Israel Launches Precise Strikes Against Iranian Targets

Oct 26, 2024

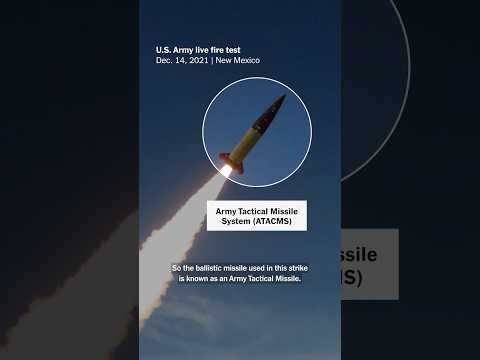

Ukraine's Historic Missile Strike Signals Shift in Conflict

Nov 25, 2024

Governor Tim Walz's DNC Address Highlights Key Policies

Aug 22, 2024

Kemp and Trump Unite Ahead of Georgia Elections

Aug 29, 2024

Elon Musk's X Faces Legal Standoff in Brazil

Sep 01, 2024

Lee Jae-myung Sentenced: Political Implications Unfold

Nov 15, 2024