Fall Home Buying Season Shows Promising Trends

Yahoo Finance

113

0

As reported by realtor.com, those looking to buy homes should consider doing so between September 29 and October 5. This timeframe reveals that buyers can save approximately $114,000 compared to the inflated summer prices. Furthermore, the availability of listings has surged, with a 37% increase noted since the beginning of the year. This is advantageous for potential buyers, as it creates a less competitive environment than typical home buying seasons. Although this year has seen a sluggish buying season, experts anticipate a drop in mortgage rates, coinciding with expectations that the Federal Reserve (FED) will reduce interest rates this month. While the FED doesn't directly set mortgage rates, its policy decisions heavily influence interest direction. The Mortgage Bankers Association notes that recent trends show mortgage rates have decreased to their lowest levels since February of the previous year, demonstrating a steady downward movement since May. This current climate presents an opportune moment for buyers in a typically slower market, making it essential for interested parties to strategize their purchase decisions accordingly.

Highlights

- • Optimal buying window is September 29 to October 5.

- • Buyers can save approximately $114,000 over summer prices.

- • Active listings increased by 37% since January.

- • Less competition in the current home-buying season.

- • Mortgage rates expected to decline further.

- • FED likely to cut interest rates this month.

- • Mortgage rates at lowest levels since February last year.

- • Overall downward trend in mortgage rates since May.

- • Slow home-buying season this year presents unique opportunities.

- • Strategic timing could benefit buyers in the current market.

* dvch2000 helped DAVEN to generate this content on

09/21/2024

.

More news

FOMC Interest Rate Decision: Impact on Solar Industry

Sep 15, 2024

Kamala Harris Reflects on Family and Voter Engagement

Sep 21, 2024

Ensuring Election Security in the U.S.: Key Insights

Nov 05, 2024

Tim and Ed's Influence in Statistics

Oct 27, 2024

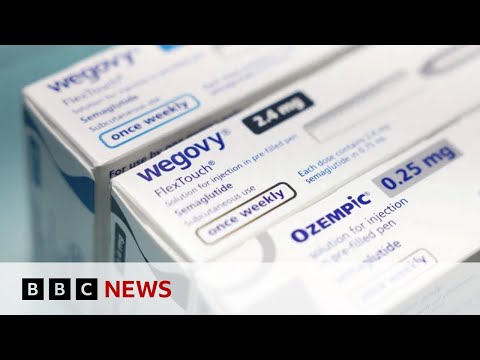

Obesity Drug Semaglutide May Slow Aging Process

Sep 01, 2024

Trump's Rally at Madison Square Garden: Highlights and Concerns

Oct 28, 2024