Investors Eye Market Signals Amid Rate Cuts and Stocks

Fox Business

126

0

In a recent Barons Round Table discussion, experts analyzed current market conditions, highlighted key investor considerations, and pointed toward potential changes on the horizon. The recent Federal Reserve rate cut sparked market fluctuations, showcasing investors' indecision over its implications. The panel, featuring Andrew Barry, Elizabeth O'Brien, and Al Root, scrutinized the effects of a half-point cut in rates and a recalibration of short-term rates, possibly signaling further cuts later this year. With FedEx struggling partly due to customers opting for cheaper delivery methods and broader economic caution, its declining stock signals concern for the industrial sector. Meanwhile, gold prices rose above $2,600 an ounce, suggesting investor caution and central banks’ increased purchases. The discussion turned to Boeing, currently facing challenges from a strike, with experts predicting an equity raise due to significant debt, underlining its ongoing transformation woes. Furthermore, luxury goods' market presents a mixed outlook, indicating that high-income consumers remain strong, despite lower earners pulling back. Notable companies like LVMH may correct past pricing issues, hinting at a potential rebound. Lastly, Nike’s recent CEO change is expected to refocus its brand and innovation strategy, which has suffered during the previous tenure. Overall, experts encourage investors to remain vigilant as the market continues to signal both caution and potential opportunity.

Highlights

- • The market reacted moderately to the Federal Reserve's half-point rate cut.

- • Investor indecision is evident, with potential future rate cuts anticipated.

- • FedEx's stock decline reflects concerns about both company and economic conditions.

- • Gold prices hitting new highs indicate investor caution and demand for safe assets.

- • Boeing faces challenges due to ongoing worker strikes and substantial debt.

- • Equity raises for Boeing are considered inevitable to address financial strain.

- • Luxury goods market shows signs of resilience amid different consumer spending behaviors.

- • LVMH and other luxury brands may need to revisit their pricing strategies.

- • Nike's leadership change aims to revitalize its brand image and innovation.

- • Overall, expert insights suggest mixed signals in various sectors of the market.

* dvch2000 helped DAVEN to generate this content on

09/21/2024

.

More news

Biggest Moon of the Year: A Night to Remember

Oct 28, 2024

Titan Submersible Wreck: Inquiry Highlights Fatal Flaws

Sep 17, 2024

Affirmations Amidst Political Debate Highlights

Sep 14, 2024

Maharashtra Political Landscape Heats Up

Oct 26, 2024

Cozy Games: A Lasting Trend with Witch Beam's Tempoo

Aug 22, 2024

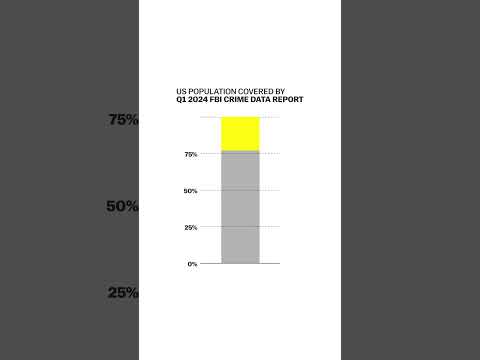

Debate Highlights Disputed FBI Crime Statistics

Sep 14, 2024