Understanding Market Rotation: An Investor's Insight

Yahoo Finance

101

0

Market rotation is a crucial concept for investors to grasp as it impacts investment strategies during fluctuating market conditions. Understanding whether markets are trending or rotating can help investors make informed decisions. Essentially, a rotating market moves sideways, as demonstrated by the NASDAQ, which has not reached a new high in several months. In contrast, the S&P 500 continues to set record highs, signaling a shift in investments among sectors. For the average investor, witnessing all-time highs in one index while another remains stagnant may create confusion. Typically, all-time highs suggest a bull market, where investment prices are rising, while consistent downturns indicate a bear market, defined by falling prices. However, the space between these extremes is characterized by market rotation, where some sectors outperform while others lag behind. This behavior maintains a level of market vitality, as investments frequently shift from one area to another, suggesting underlying economic dynamics. Therefore, being aware of how different sectors perform and rotate can aid investors in navigating their portfolios successfully, as knowing when sectors are thriving can provide opportunities for advantageous investment.

Highlights

- • Market rotation indicates shifting performances of market sectors.

- • NASDAQ has not reached a new high for several months.

- • S&P 500 continues to achieve record highs.

- • Bull markets are associated with rising asset prices.

- • Bear markets are marked by consistent price declines.

- • Market rotation helps keep the market active and dynamic.

- • Different sectors can thrive while others fall behind.

- • Investor strategies should adapt according to market conditions.

- • Awareness of sector performance is critical for investors.

- • Vitality of the market relies on the effective rotation of investments.

* dvch2000 helped DAVEN to generate this content on

09/28/2024

.

More news

Harris Faces Criticism Over Border Accountability

Oct 22, 2024

Election Tensions Rise Over Abortion Rights Issues

Oct 21, 2024

Unraveling Relationships in the Bride Series

Oct 27, 2024

Georgia Leaders Rally Against Abortion Ban Risks

Sep 20, 2024

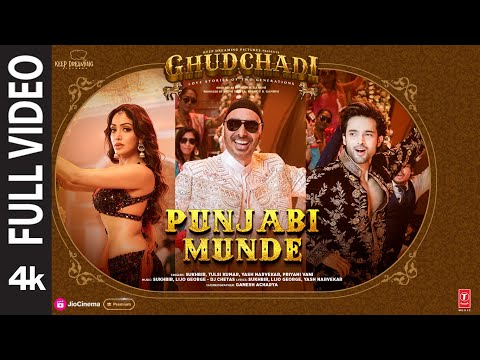

पंजाबी मस्ती: घर जाने दे...

Aug 15, 2024

Knicks Triumph Over Pacers in Intense NBA Matchup

Oct 26, 2024