Federal Reserve Hints at September Rate Cut Amid Improved Inflation

201

0

The Federal Reserve announced its decision to leave interest rates unchanged but provided indications that a rate cut could be on the horizon for September. This announcement aligns with market expectations and comes as the FED acknowledges progress towards the 2% inflation target. The labor market is showing signs of cooling, which diminishes inflationary pressures. A potential rate cut in September would be the first since the pandemic, reducing borrowing costs on mortgages, auto loans, and credit cards. This timing, close to the upcoming election, adds a political dimension, although FED Chair Powell emphasized that the FED operates independently of political pressures and bases its decisions solely on economic data. While lower borrowing costs would benefit consumers and businesses, noticeable effects like lower mortgage rates may take longer to be felt. The FED aims to balance reducing inflation while sustaining a robust job market, evident in recent progress from peak inflation of 7% to 2.5%. Overall, the FED is carefully weighing its decisions to support both inflation reduction and economic strength.

Highlights

- • FED leaves interest rates unchanged.

- • Progress towards 2% inflation target acknowledged.

- • Labor market cooling, reducing inflationary pressures.

- • Potential rate cut in September hinted at.

- • First rate cut since the pandemic could lower borrowing costs.

- • FED insists decisions are based on data, not politics.

- • Possible political implications with the election nearing.

- • Lower borrowing costs to benefit consumers and businesses.

- • Effects on mortgage rates may take time to manifest.

- • FED aims to balance inflation reduction with job market strength.

* dvch2000 helped DAVEN to generate this content on

07/31/2024

.

More news

US Election Cycle Causes Economic Uncertainty

Sep 04, 2024

North Korean Soldiers Support Russia in Ukraine War

Oct 18, 2024

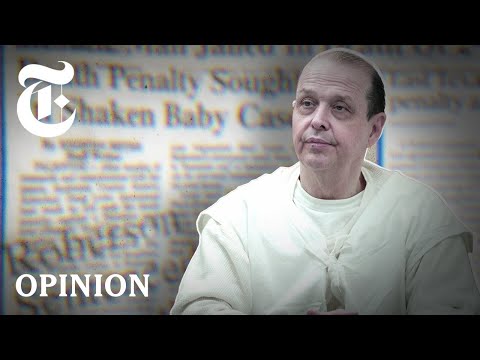

Reevaluation of a Death Row Conviction

Jul 31, 2024

China Circumvents US AI Chip Restrictions: Insights

Oct 17, 2024

Youth Aggression at Recent City Event

Oct 31, 2024

Flooding in Southern Thailand: Government Response Criticized

Dec 02, 2024